home | solutions

What is e-Mandate?

e-Mandate provides a convenient and secure method for businesses to collect recurring payments from their clients. This process not only enables businesses to ensure timely payments without the need for manual handling, but also spares customers the effort of remembering to make payments and avoids potential late fees or discontinuation of service.

e-Mandate service by NPCI serves as an electronic version of a mandate, which is an established instruction given to a customer's bank, authorizing the automatic debiting of a fixed amount to another bank account. Through e-Mandate, customers have the capability to register, modify, and cancel mandate online.

With the e-Mandate, individuals can conveniently authorize recurring payments using their Net banking or Debit card credentials.

e-Mandate and e-NACH are frequently used interchangeably.

e-Mandate or e-NACH Benefits

- Nationwide reach with large bank network

- Better liquidity Management with immediate Debit realization

- Future ready technology with multilevel security with host-to-host integration

- Cost effective

- High volume capacity

- Response for all transactions

- Strong Audit trail

Why SoftScience?

- Pricing – most cost effective in the industry

- Platform – intelligent tailored made platform

- Protection – 256-bit encryption

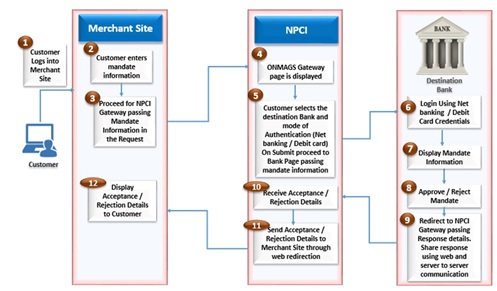

e-Mandate registration process

If the pictogram above resembles a roller coaster ride, please don't hesitate to reach out to us. We'll be happy to provide further clarification

FAQs

- How long does it take to register e-Mandate?

- Can I register any new bank for e-Mandate or it is only for the existing bank accounts?

- What is the minimum & maximum limit amount set for e-Mandate?

- Can I Cancel / Amend / Revoke/ Suspend an existing e-Mandate?

- What is the limit for various types of e-Mandates?

- What can be the maximum duration for which a e-Mandate can be issued?

- How many are Banks live with e-Mandate services

- Is Negotiable Instruments Act applicable to e-Mandates?

e-Mandate registration is REAL Time. For banks where e-Mandate facility is not available, Offline Mandate registration needs to be done, which takes around 21 days.

There is no limit to the number of bank accounts you can register for the e-Mandate. You have the option to register both your existing and newly opened bank accounts for the e-Mandate facility.

e-Mandate requires a minimum amount of Rs 5000 and allows for a maximum of Rs 1 crore. While it is possible to adjust and increase this amount, reductions are not permitted. The highest allowable Mandate amount is contingent on the customer's bank. It is advisable for customers to consider setting a higher e-Mandate amount, enabling smooth processing for transactions of varying sums without the necessity of registering a new e-Mandate or increasing the limit.

Yes. It can be done by the Sponsor bank.

For recurring payments - Rs 10 lakhs and For Security mandate – Rs 50 lakhs

Effective April 01, 2024, e-Mandate can be for a maximum duration of 40 years.

46+ Banks are live with e-Mandate services through Debit card and Net Banking mode which includes large Banks and PSUs.

Yes, as per the clarification from RBI, Section 138 of Negotiable Instruments Act, 1881 shall be applicable in case of dishonour of e-Mandates

What is Escrow Banking?

This financial intermediation service involves a third party acting as a custodian of funds or assets on behalf of two or more parties engaged in a pre-defined transaction. The presence of a neutral intermediary is crucial to ensuring the transaction's secure execution, eliminating any possibility of risk.

This mechanism protects the interests of all involved parties by ensuring that the payments are only made when the terms of the agreement (tripartite agreement) are satisfactorily completed, reducing the risk of fraud or default.

In India, escrow accounts are commonly used in various sectors such as real estate, mergers and acquisitions, loan disbursements, and large business deals to ensure transparency and to minimize risk. The funds remain with the escrow agent (usually a bank) until all contractual obligations are met, at which point the funds are released to the rightful party.

Benefits of Escrow Banking

- Risk Mitigation: Escrow banking reduces the risk of fraud or default by ensuring that funds or assets are only released when all agreed-upon conditions are met.

- Neutral Third Party: The escrow agent acts as an impartial intermediary, fostering trust between parties who may not know or fully trust each other.

- Transaction Security: Funds and assets are securely held by the escrow agent, protecting them from misuse or premature release.

- Clear Terms Enforcement: The escrow agreement clearly defines the conditions for releasing funds, minimizing disputes and misunderstandings.

- Facilitates Complex Transactions: Escrow banking simplifies complicated deals, such as mergers, acquisitions, and real estate sales, by managing payment flows according to contractual milestones.

- Peace of Mind: Parties involved gain confidence knowing that the transaction will proceed fairly and securely.

- Legal Protection: Escrow agreements are legally binding, offering protection and recourse if any party fails to meet their obligations.

Use Cases of Escrow Banking

- Real Estate Transactions (Real Estate Escrow): When buying or selling property, the buyer deposits the payment into an escrow account. The funds are released to the seller only after all conditions like property inspections, title clearance, and registration are completed.

- Mergers & Acquisitions (M&A) (Financial Escrow): In corporate acquisitions, escrow accounts hold a portion of the purchase price to cover any post-transaction adjustments, warranties, or indemnities.

- Online Marketplaces & E-commerce (Buyer-Seller or Online Escrow): Funds paid by a buyer are held in escrow until the product is delivered and accepted, protecting both parties from fraud or non-delivery.

- Loan Disbursement (Mortgage or Lending Escrow): Lenders use escrow accounts to ensure that loan amounts are disbursed only after the borrower meets certain conditions, such as providing collateral or documentation.

- Legal Settlements (Litigation or Legal Escrow): Settlement amounts are placed in escrow to be distributed after all legal formalities and agreements are finalized.

- Construction Projects (RERA Escrow): Funds from the project owner are held in escrow and released to contractors or subcontractors based on completed milestones or inspections, ensuring quality and timely delivery.

- Intellectual Property (IP) Transactions (IP Escrow): In licensing or sale of patents and copyrights, escrow services hold payment or IP assets until all contract terms, such as patent transfers or licensing approvals, are fulfilled.

- Software Development (Software or Source Code Escrow): Payment for software development is held in escrow and released only when the software meets predefined specifications or passes testing phases.

- Import/Export Trade (Trade Escrow): Escrow ensures payment security in international trade by holding funds until goods are shipped, received, and inspected, reducing risks caused by distance and differing regulations.

- Government Contracts: Escrow accounts help manage funds for government procurement contracts, ensuring contractors meet delivery and compliance requirements before payment release.

- Crowdfunding & Fundraising: Funds collected from donors or investors are placed in escrow until the project reaches a funding threshold or milestones, protecting contributors' interests.

- Rental Security Deposits (Rent Deposit Escrow): Escrow services can hold tenants' security deposits, ensuring fair return upon lease completion after any damage assessment.

Why SoftScience for Escrow Banking?

- Services

- Range of escrow services offered (real estate, financial, transactional, construction, IP escrow, etc.)

- Additional support like dispute resolution, automated disbursement, document handling, Dashboard creation / management and regulatory compliance

- Availability of customized escrow agreements and multi-party escrow options

- Integration with digital platforms for seamless transactions via APIs

- Fees

- Transparent fee structure (flat fees, percentage-based, or tiered pricing)

- Comparison of fees with industry standards and competitors

- Clarity on payment terms and refund policies

- Reliability and Reputation

- Track record of successful transactions and client satisfaction

- Trustworthiness and impartiality as a neutral third party

- Regulatory approvals and compliance certifications

- Experience and Expertise

- Rich experience in escrow services and industry expertise across all banks in India

- Experience handling complex or high-value transactions

- Sector-specific knowledge (e.g., real estate, M&A, e-commerce)

We invite you to get in touch with us!

What is e-Commerce?

e-commerce or electronic commerce or platform based online commerce is the latest way buying and selling products and services including sharing of information via established connected electronic networks. Nearly every imaginable product and service is now available through e-commerce. The companies operate online through websites, mobile apps, or other digital platforms, offering a convenient way for customers to shop round the clock at its own convenience from virtually anywhere in the world. This offering has helped companies (especially those with a narrow reach, like small, local businesses) gain access to a wider market.

e-commerce business models

- Business to Consumer (B2C): When goods or services are sold to an individual consumer by a business entity e.g. A user can buy a pair of shoes from an online e-commerce platform.

- Business to Business (B2B): When goods or services are sold by business houses to another business, e.g. A software-as-a-service is sold by a business for other business's operational to use.

- Consumer to Consumer (C2C): When goods or services are sold by one consumer to another consumer using existing platform. e.g. The goods may be in a good condition and can be disposed to another user.

- Consumer to Business (C2B): When a consumer's own products or services is sold to a business or organisation for their consumption in order to operate their business.

- Business to Government (B2G): In this business houses sell products or services to the government agencies through online portals or market places.

Benefits of e-commerce

- Convenience: e-commerce runs 24 hours a day and at all times without a break. Consumers can buy at their convenience and business owners can make sales while they sleep.

- Increased selection: Many stores offer a wider array of products online than they could ever carry in their brick-and-mortar counterparts. And many stores that solely exist online, offer consumers exclusive inventory that is unavailable elsewhere.

- Potentially lower start-up costs: e-commerce companies may require a warehouse or storage site and they usually don't need a physical storefront. The cost to operate digitally is often less expensive than needing to pay rent, insurance, building maintenance and property taxes.

- International sales: As long as an e-commerce store can find a way to ship its products to its customers, it can sell to anyone in the world and isn't limited by physical geography.

- Opportunity to collect valuable data: Willingly or unknowingly, consumers share a lot of information on their interests and shopping habits when they buy or even just browse online. Site owners can monetize this data in a number of ways, using it themselves and/or trading it with others including group companies operating in multiple domains.

Use Cases of e-commerce Solutions

- Online retail: One of the well-known uses of e-commerce is online retail where business sell products directly to consumers through their online store, website or mobile application.

- Digital product and services: e-commerce is also commonly used for the sale of digital product and services such as Music, eBooks and online courses.

- Online Market places: e-commerce market places provide a platform for business and individuals to sell their products to large audience across geographies.

- Auction sites: Auction sites allow user to bid on purchase items from other users.

- Online banking and financial services: e-commerce platforms are extensively used for online banking and financial services, including payments processing, bills payment and money transfer.

- Online Booking and reservations: e-commerce is used for booking and reservations of flights, hotels, rental cars and other travel related services.

- Food Delivery: e-commerce platforms are used for online ordering and delivery of foods from the restaurants.

- Online Advertising: e-commerce platform is also used for online advertising where business can advertise their products and services to a large audience across geographies.

Why SoftScience for e-commerce?

- Vast selection and pricing: SoftScience offers complete range of products cum solutions often at competitive prices, making it a convenient one-stop-shop.

- Customer experience: Key features like one-click ordering, user reviews, personalized recommendations, and a straightforward return process create a seamless and trustworthy shopping experience.

- Fast and reliable delivery: Through its extensive logistics network and services the company provides fast and dependable delivery options.

- Personalization: SoftScience uses purchase history and browsing behaviour to provide personalized recommendations, which can improve usability and help users discover new products.

- Access to a huge customer base: Softscience's platform provides sellers with access to thousands of customers globally, which is a major benefit for growing a business.

- Seller support: SoftScience provides support for launching and managing a business on its platform, including tools for advertising, secure payments, and seller support services.

- Loyalty programs: SoftScience rewards loyal customers with benefits like free shipping and early access to deals.

- Seller tools: SoftScience offers tools for business insights, market trends, advertising, and more.

- Scalability: Offers the potential for businesses to scale and grow by reaching a nationwide audience.

- Support for local businesses: Actively works to empower small and medium-sized businesses to succeed on its platform.

We invite you to get in touch with us!